All about Simply Solar Illinois

Not known Facts About Simply Solar Illinois

Table of ContentsSimply Solar Illinois Things To Know Before You BuySimply Solar Illinois Can Be Fun For AnyoneThe Facts About Simply Solar Illinois UncoveredThe Definitive Guide for Simply Solar IllinoisNot known Factual Statements About Simply Solar Illinois

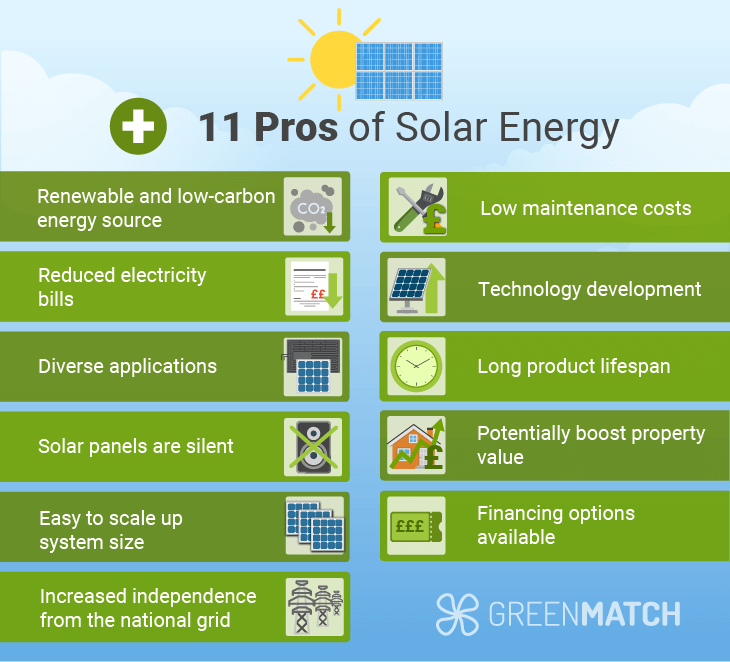

Our group companions with neighborhood communities throughout the Northeast and past to supply tidy, budget friendly and trusted power to cultivate healthy and balanced areas and keep the lights on. A solar or storage project delivers a variety of advantages to the community it offers. As modern technology advancements and the price of solar and storage decrease, the economic benefits of going solar proceed to increase.Support for pollinator-friendly habitat Habitat reconstruction on contaminated websites like brownfields and land fills Much required color for animals like lamb and chicken "Land banking" for future farming usage and soil high quality improvements As a result of climate modification, extreme weather condition is becoming extra regular and turbulent. Because of this, home owners, businesses, areas, and energies are all becoming increasingly more interested in safeguarding energy supply remedies that offer resiliency and energy safety and security.

Environmental sustainability is one more key driver for companies investing in solar energy. Lots of firms have durable sustainability goals that consist of minimizing greenhouse gas exhausts and making use of much less sources to aid decrease their effect on the native environment. There is a growing necessity to resolve environment adjustment and the stress from consumers, is arriving degrees of organizations.

The 4-Minute Rule for Simply Solar Illinois

As we approach 2025, the assimilation of solar panels in industrial jobs is no more simply an alternative however a strategic need. This blogpost digs right into just how solar power works and the complex advantages it offers business buildings. Solar panels have actually been used on household buildings for several years, however it's only recently that they're ending up being extra common in industrial construction.

In this write-up we review just how solar panels work and the advantages of using solar energy in industrial structures. Electricity prices in the U.S. are raising, making it a lot more costly for organizations to operate and much more difficult to plan in advance.

The U - Simply Solar Illinois.S. Power Details Administration expects electrical generation from solar to be the leading source of development in the united state power market through the end of 2025, with 79 GW of brand-new solar capacity forecasted to find online over the next two years. In the EIA's Short-Term Energy Overview, the firm said it expects renewable energy's overall share of electricity generation to climb to 26% by the end of 2025

The Definitive Guide for Simply Solar Illinois

The photovoltaic or pv solar cell takes in solar original site radiation. The cables feed this DC electrical power right into the solar inverter and transform it to rotating power (AIR CONDITIONING).

There are several means to save solar power: When solar energy is fed right into an electrochemical battery, the chain reaction on the battery parts maintains the solar energy. In a reverse response, the existing leaves from the battery storage for consumption. Thermal storage uses tools such as liquified salt or water to retain and soak up the heat from the sunlight.

This system shops pressed air in big vessels such as storage tanks or all-natural formations (e.g., caves), then launches the air to produce electrical energy. Power is just one of the largest ongoing expenses that industrial buildings have. Photovoltaic panel considerably decrease power prices. While the preliminary financial investment can be high, overtime the price of installing solar panels is recovered by the cash reduced electrical energy expenses.

Everything about Simply Solar Illinois

By mounting photovoltaic panels, a brand shows that it respects the atmosphere and is making an initiative to lower its carbon impact. Structures that count totally on electric grids are vulnerable to power outages that occur throughout negative climate or electric system malfunctions. Photovoltaic panel installed with battery systems permit business buildings to continue to work during power interruptions.

How Simply Solar Illinois can Save You Time, Stress, and Money.

Solar power is just one of the cleanest types of energy. With durable warranties and a production life of up to 40-50 years, solar financial investments add considerably to ecological sustainability. This shift towards i loved this cleaner energy resources can cause broader financial advantages, consisting of minimized environment adjustment and environmental deterioration prices. In 2024, homeowners can profit from government solar tax rewards, allowing them to counter nearly one-third of the acquisition price of a solar system via a 30% tax obligation credit rating.